Do you need to teach kids about money? One of the best life lessons you can teach kids is how money works.

Kids who develop a solid understanding of money management, from the importance of budgeting to essential spending and saving, are more likely to succeed in managing finances as they grow older.

Today, we guide the easy and age-appropriate methods to introduce children to financial literacy.

1. Why Is Teaching Kids About Money Important?

Here’s why it’s essential:

- Teaching Responsibility: Children learn that money is a resource, not just something with which to buy toys and candy. This can help them make more conscious decisions as they mature.

- Prepares Them for Real Life: Financial literacy helps children cope with money by teaching them to use it even when they are employed, receive allowances, or open their first bank account.

2. How to Teach Kids About Money

here is step-by-step:

A. Learn Early (Age Apps) A. Ease into the Money Concepts

Children and money concepts teaching best meets the child at their age-based understanding. Here are examples of what to introduce when.

- For ages 3-5, begin with basic concepts like spending and saving. Children understand that you need money to purchase things and sometimes must wait to afford what you want.

- 6-9: Discuss decisions and sacrifices. Something like, “Buy this now, and you won’t have to buy that later.“ It is a great age to start teaching how money can be saved for something unique.

- Ages 10-12: Discuss Budgeting, Earnings, and the basics of needs vs. wants. Train them on setting a small allowance to suffice some things they may wish for.

- 13+-year-old: End with how you should save your profits and keep some pay-to-trade by investing concepts, bank accounts of value, and hard work. Older children may be ready to grasp how a savings account works or what it means to invest your money.

B. Illustrate Money Concepts with Real-Life Examples

There are opportunities to teach money through everyday activities. The more invested kids are in the game and the more they see what all these S.T.E.M. lessons look like in real life, the more they remember it.

- At the Grocery Store, Include them in decisions. For example, “Which item is a better deal?” or “Would both items be within our budget?”

- Family Goals: If you are saving up for a family vacation or purchasing a new kitchen appliance, demonstrate how budget management helps you reach that goal in time.

C. Daily Interaction Teachings

Talking about money in everyday moments that teach is a great way to make the learning experience feel more natural and relatable.

- Identify Money Uses: Explain to them how money is spent, such as paying bills and buying groceries.

- Give Them Control of the Green: Handing them some cash for basics allows children to make small spending decisions, which keeps them responsible.

3. Great Money Skills Activities and Tools to Use

Money: If you want your children to learn about money, the very first thing they must do is appreciate it. Think of some boredom, dull, exciting financial lessons like these:

A. Money Games for Learning

Games are a risk-free, experiential way to learn more about money. They also introduce spending, saving, and sometimes investing ideas in a way that children would most likely enjoy.

- Board Games: Monopoly and The Game of Life explain how money theoretically works. Set in a world that mimics reality, these are excellent introduction games about spending and saving—not to mention going into debt.

- Apps to Teach Real-world Money Skills: Online money apps such as PiggyBot or Bankaroo exist. Kids can use these apps to manage electronic pretend cash, set savings targets, and spend money.

B. Money Jars or Envelopes

The money jar strategy is a tried-and-true system that familiarizes children with budgeting by compartmentalizing cash.

- Categorize: Divide your money into three categories (Spending, Saving, Giving) and use jars. This system advocates segregating the cash for several uses. They have jars in which they are given pocket money and different jars for their savings account (just a part of the whole bank scenario) so that I can give them a basic understanding of budgeting.

- Expected Goals: Work on creating saving goals with them, such as achieving a certain amount to save for that new toy or book. They will realize that saving modest amounts each week gets them closer to their goal.

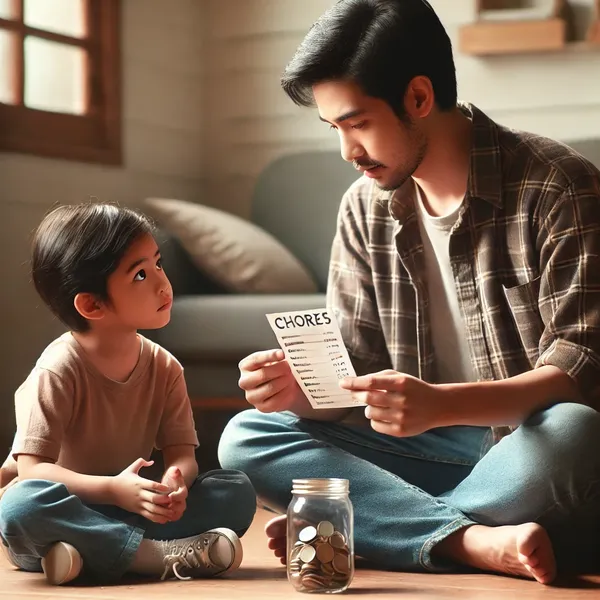

4. Allowances and chores as a teaching tool.

Allowance is such a tremendous money-skill practice run! Teach kids how rewards and lessons about that work with an allowance.

- Provide a Weekly Allowance: Divide the allowance according to specific completed chores or tasks. Let kids spend it on their wants today or save for big goals.

- Recommend Establishing a Savings Goal: Train them to establish an objective, such as conserving for a toy, computer game, or adventure. They will feel proud when they achieve that goal.

5. Open a Kid’s Savings Account

Your children will have their account, which will help them establish independence and learn about banking.

A. Explain the Role of Banks

Children will understand that keeping money safe in a bank is essential. Banks also give you extra pennies to save part of your pocket—this bonus is called interest.

- Teach Basic Bank Functions: Explain that a bank is where money lives when you are not using it and how it eats your cash to nibble on over time.

- Take them to the Bank: Make it a special day and have them visit YOU at work as you take them along on your next bank errand—opening up their first savings account. It makes it more real for donors to see where their money goes.

B. Track Progress Together

Kids get to watch their money grow, which is a sound reinforcement for savings.

- Display Deposits and Interest: Explain that putting in more means their balance grows faster, with interest adding a little extra.

6. Budgeting Lessons: Simple Exercises for Teaching Kids

Budgeting is a technique that can sometimes prevent large sums from being spent on small, everyday occasions.

Follow the same concept with your children, and they will learn to handle larger sums over time.

- Family Budgeting Activity: Let them plan a movie night or other small family event and get crafty with the fun parts. Tell them how much they can spend on snacks, drinks, and a movie rental to see where the money goes.

- Build a Spending Pie Chart: Ask them to keep track of most categories where they spend their money, which will show how much can be saved over the years.

7. Introducing Wise Spending Habits

Spending wisely involves determining when to buy and when not to buy. Teach the kids that taking moments before spending money is okay and that a bit of comparison is sometimes ideal.

- Needs vs Wants: Explain whether something is necessary or nice to have. Tell them that needs come first, but wants can be saved for.

- Teach Them Smart Shopping Skills: Learn to price compare between like items and where/when they go on sale.

- Teach Patience: Help them understand that waiting may provide a more attractive outcome or deal. Get them to stop and think before they reign in their money.

8. Invite Children in the Higher Age Group to Earn

As children become older, they want more independence. It offers their own money to be saved; overtime jobs allow them to earn for themselves & also realize how effort equals value.

- Lemonade Stands or Yard Sales: Lemonade stand yard sales are the best first business venture to teach your child about making and spending money.

- Doing Family Chores for Pay: If kids are older, they can also complete tasks in the home that have a small price attached (yard work or car washing) in addition to their regular chores.

9. Introducing the Concept of Investments

Investing with older children is a thrilling vehicle for them to witness money grow over extended periods. Simple overviews of Stocks, Real Estate, and Small Businesses can be helpful.

A. Make Investing Understandable to Kids

Investment talk does not have to be complicated. Concentrate on what they are familiar with.

- Stocks and Shares: Mutual funds (which pool cash from many investors to buy shares of a company or companies) are one way to own a small piece of the pie. When a company does well, its stock increases in value.

- Real Estate Basics: Teaching that some people buy homes or apartments to sell for a profit, and others rent them out.

B. Risk/Reward Conversation

You might be investing some money in riskier ventures, but others have the potential to grow a lot (and maybe lose, too).

- Risk and Reward: Educate that a savings account is secure but slow to grow while other investments like stocks can provide more significant rewards with more risks.

10. The Habits of Financial Life

Because money management routines are habits, they require time to grow.

- Family Budget Meetings: Establish a family tradition of reviewing how you spend and save money. The children will learn well from watching you handle household finances and get a sense of responsibility for their spending decisions.

- Future Goal-Setting: Guide them in establishing more long-term goals, such as saving for college or their first car. The objectives give them an end to work towards and keep them inspired.

- Work on Financial Freedom: As kids age, teach them money management. Provide them with tools, such as a small planner or an app, where they can list their expenses and note down allowances. Watching their growth over time will help your child understand how money-saving works.

Conclusion

Teach kids about money is one of the best skills you have that is worth teaching. We should teach them engaging, age-appropriate, and interactive lessons.

In that case, your children will walk away with the ability to manage their money responsibly by weaving through each lesson in a fun way.

Make tiny decisions and get them involved in real-life money scenarios (AKA experiential learning) that will allow them to earn or save (maybe invest). With your direction, they will have a good foundation for making sound financial decisions as they age.